Guiding behavioral change for an AI-powered investing app

Grew funded accounts from fewer than 200 to over 15,000 by reshaping time, risk, and choice

ICONTEXTAI-managed hedge funds for anyone, for everyone

Q.ai set out to democratize institutional investing. No million‑dollar minimums. No management fees. Just AI portfolios that beat the market—delivered through a phone to a broad consumer market that historically had never had access to hedge funds before, much less funds backed by quant-analytics and AI.

The algorithms worked. The quants (AI) delivered market-smashing returns. By all intents and purposes, this was poised to equalize wealth-building opportunity across the board.

II31 of every 1,000 sign‑ups became investorsCHALLENGEStrong performance, few investors

Q.ai’s Investment Kits beat every benchmark we tracked—S&P 500, MSCI World, even smart‑beta ETFs—yet the app limped along with a 3‑star rating and a 3.1 % funding rate. Public reviews branded the UI “clunky,” “too slow,” or “another trading app I don’t need.” I suspected a larger silent churn: users who bailed before they bothered to complain.

My objective was to trace every drop-off, diagnose the root cause, and increase funded-account conversion. The CEO’s target was 5–6%. I aimed higher.

IIIDISCOVERYA day‑trading mask on a long‑term machine

User interviews, session replays, and a wall of App Store reviews all pointed to one root issue: Q.ai’s interface trained people to behave like retail traders even though the product required the diligence of a wealth manager. Quant data confirmed it—users bounced between funding, kit browsing, and re‑allocation screens in loops that never ended with a single funded account.

Legacy UI: Defaulted to daily views and red/green volatility signaled instant actions where there was no action to be taken because of the AI optimization engine and funds structure.Misleading UI patterns and mismatched mental models led to liquidations

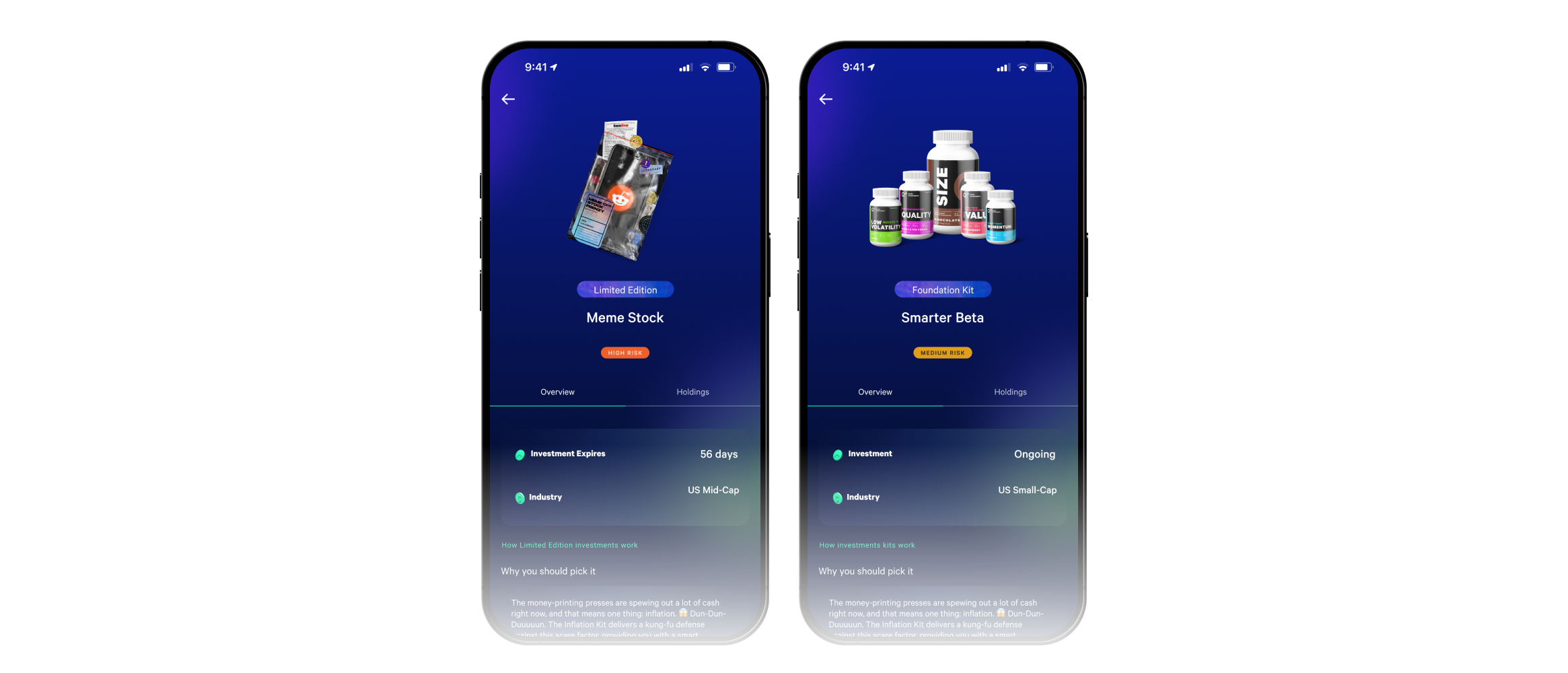

Pill‑bottle art made Smarter Beta look playful, not like the best‑performing kit on the platform.Playful metaphors were interpreted literally, hiding real value

Even the imagery worked against us. Smarter Beta, the highest-return kit, was presented with supplement-bottle imagery that undermined its value. Users rarely added it—assuming the kit was comprised of fitness-related stocks as opposed to its actual holdings.

“UI cues, copy, and visual metaphors all mismanaged expectations, fractured workflows, and buried Q.ai’s real advantage.”

By the end of discovery, the pattern was clear: UI cues, copy, and visual metaphors all mismanaged expectations, fractured workflows, and buried Q.ai’s real advantage. We didn’t need smoother sign‑up flows; we needed to reframe time, risk, and choice from the first tap.

Conventional trading patterns—1-day/1-week tabs, red-green ticks, dollar-first hierarchies—mirrored the apps users already knew, so they expected instant action. But Q.ai’s hedge-fund mechanics required Kit mixes, T+2 settlement, and weekly rebalancing. The UI aligned with prior habits, not with how Q.ai actually worked—driving confusion, anxiety on daily dips, and rapid account liquidations.

Vague yellow alerts signaled danger instead of progress—and offered no next step.Dead-end alerts broke trust

Communication failures compounded the mismatch. Error banners flashed “Action required” with no pathway to resolve KYC checks; funding loops broke silently when Plaid timed out (not Plaid’s fault); and the app never clarified why trades settled on T+2. Users hit dead ends, blamed the product, and left.

IVShift asset traders to wealth managers

Recognizing the fundamental misalignment problem, we developed a strategy to shift user behaviors toward long-term wealth building. The objective was layered: achieve operational excellence by designing for behavioral change. Design would solve user abandonment at key touchpoints by reshaping how users thought about investing. Three core principles guided this vision.

-

sell horizons, not hype

-

turn compliance and delays into reassurance

-

track the journey, not the ticker

STRATEGYV

Product Design

PRODUCT DESIGNTurning trading reflexes into wealth‑building habits

We rebuilt Q.ai from the first tap outward. Every screen, label, and delay now anchors around diligence, clarifies risk, and guides users toward funded, goal‑driven portfolios. The result is a single behavioral system—quiet on the surface, strategic under the hood.

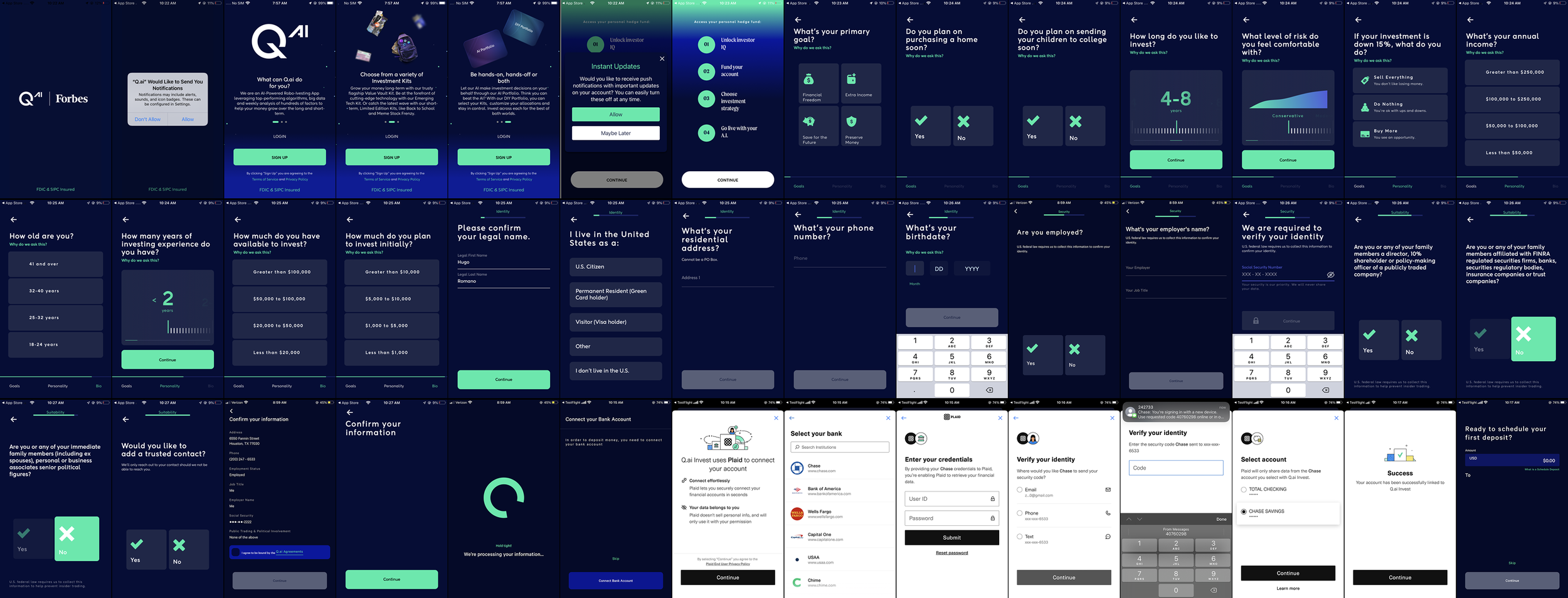

Onboarding quiz questions capture timeline, income, volatility comfort, and life goals transforming answers into strategies and goalsOnboarding created a throughline for new investors. Their answers informed the AI engine, which returns a personalized investing plan, proposed goal, and strategy. Conflicts trigger instant recalculations, turning uncertainty into agency. AI guidance translated into funding, and funding led to progress.

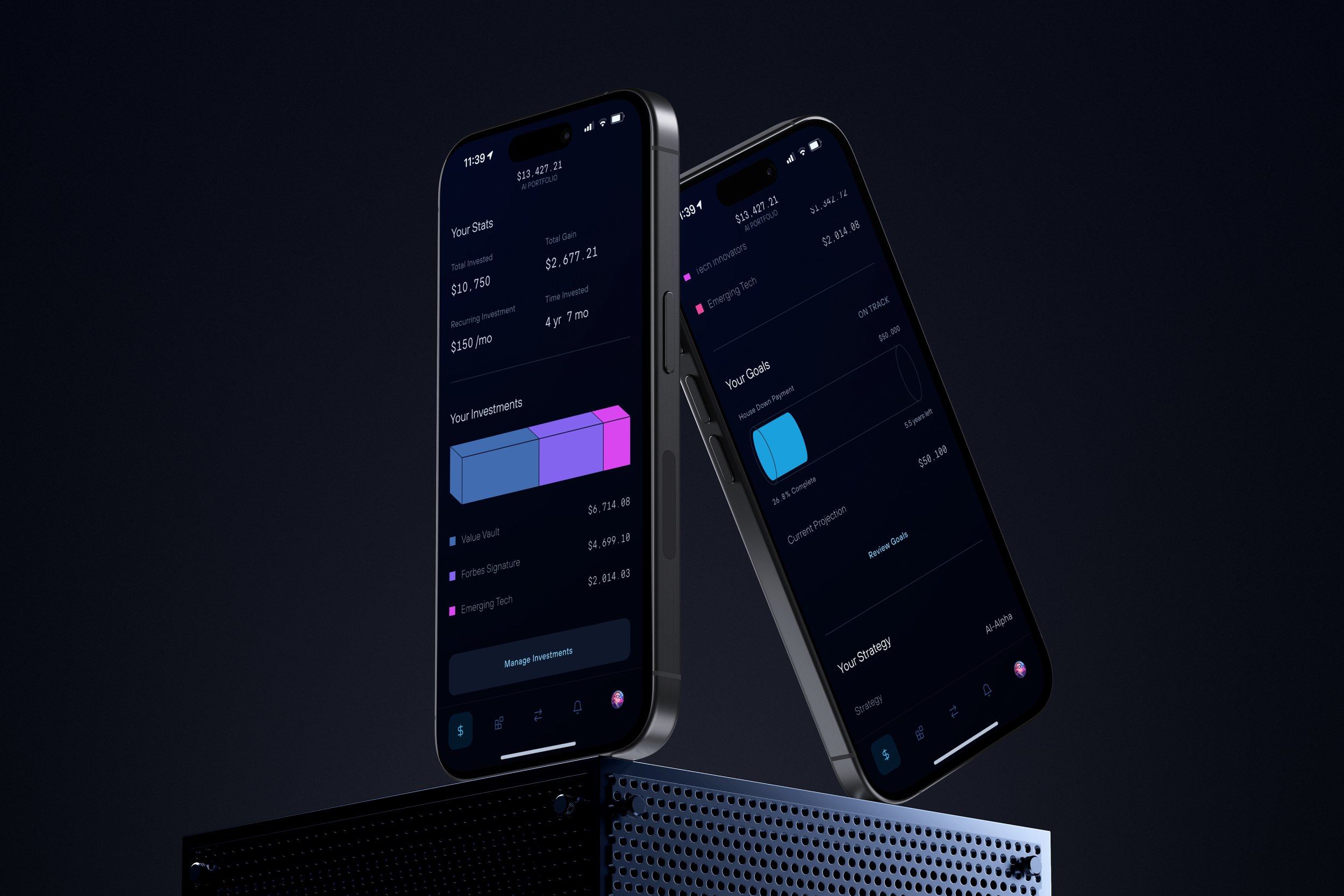

A 90‑day curve, goal tube, and dotted projection replace day‑trader micro‑spikesThe new dashboard frames time as the product. Four numbers—invested, value, monthly contribution, goal progress—anchor the view. A tube‑style bar fills toward the user’s target; the dotted line projects future value, nudging longer horizons without a word of persuasion.

Instead of overwhelming choice, the AI presented contextual options. Your personalized portfolio came first. Additional strategies appeared only when they enhanced your specific goals.

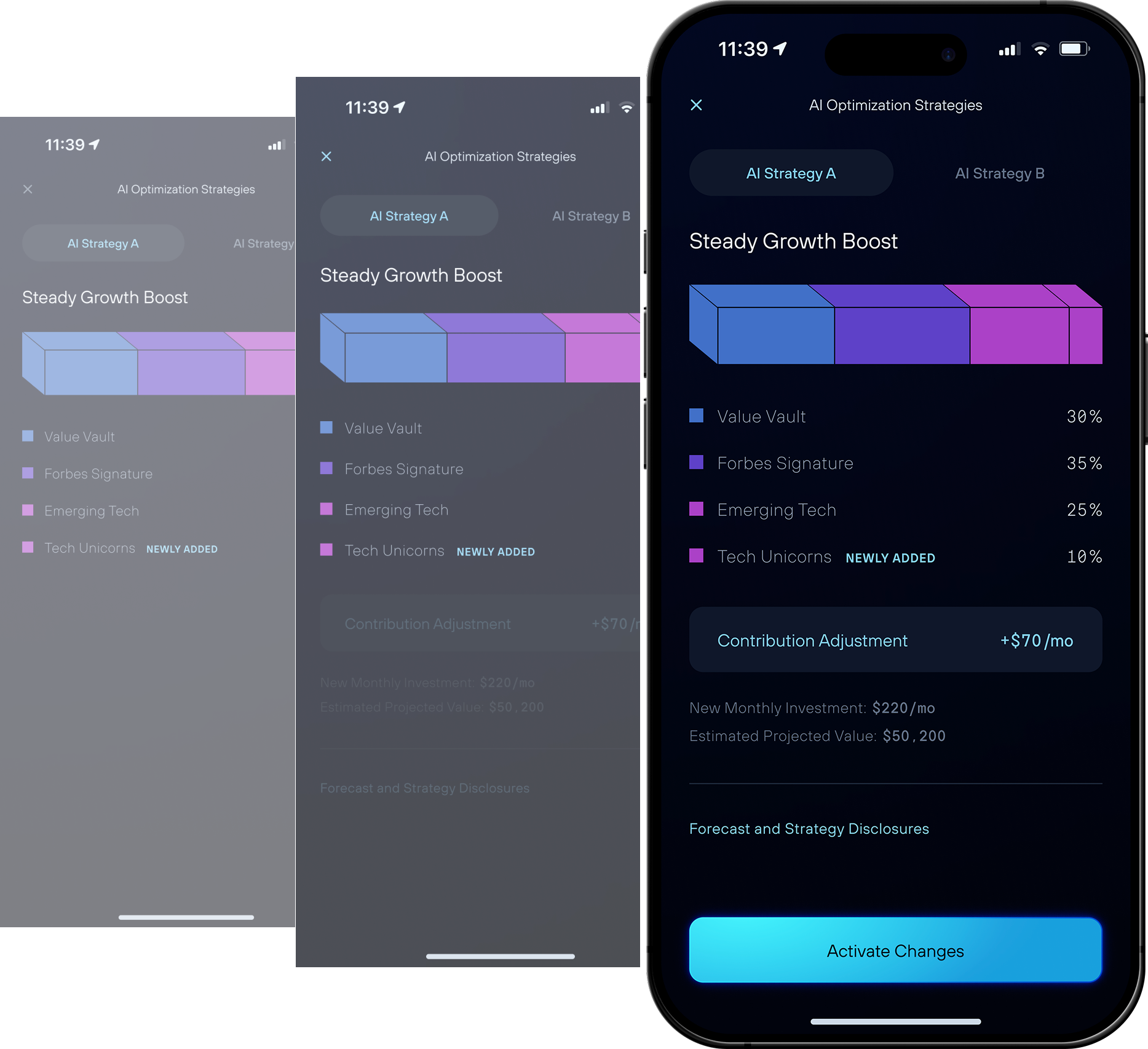

The contribution card fades in 0.4 s after the optimisation overlay loads, lowering cognitive load.Then came the crucial moment: reality check. When projections fell short of goals, the AI presented optimization strategies. The interface showed exactly what changes would bridge the gap—perhaps adding Tech Unicorns to boost growth potential, or increasing monthly contributions by $70. The visualization made trade-offs tangible: "To reach your $50,200 target, invest $220 monthly with this enhanced portfolio mix." No judgment. Just clear options. Users could accept the AI's recommendation, adjust their goal, or explore alternative strategies. Every change triggered instant recalculation, maintaining trust through complete transparency.

Steady, Balanced, Growth—plain labels, color‑coded badges, no fear‑laden ‘risk.’We transformed investment terminology from anxiety-fueled to clarity. "Risk" became "investment profile." More importantly, strategy descriptors evolved:

Steady (predictable growth, lower volatility)

Balanced (optimal for most goals)

Growth (ambitious targets, higher volatility)

"Volatility" replaced "risk" throughout. Users understood that Growth strategies meant bigger swings—both up and down. No surprises. No fear. Just reality clearly communicated.

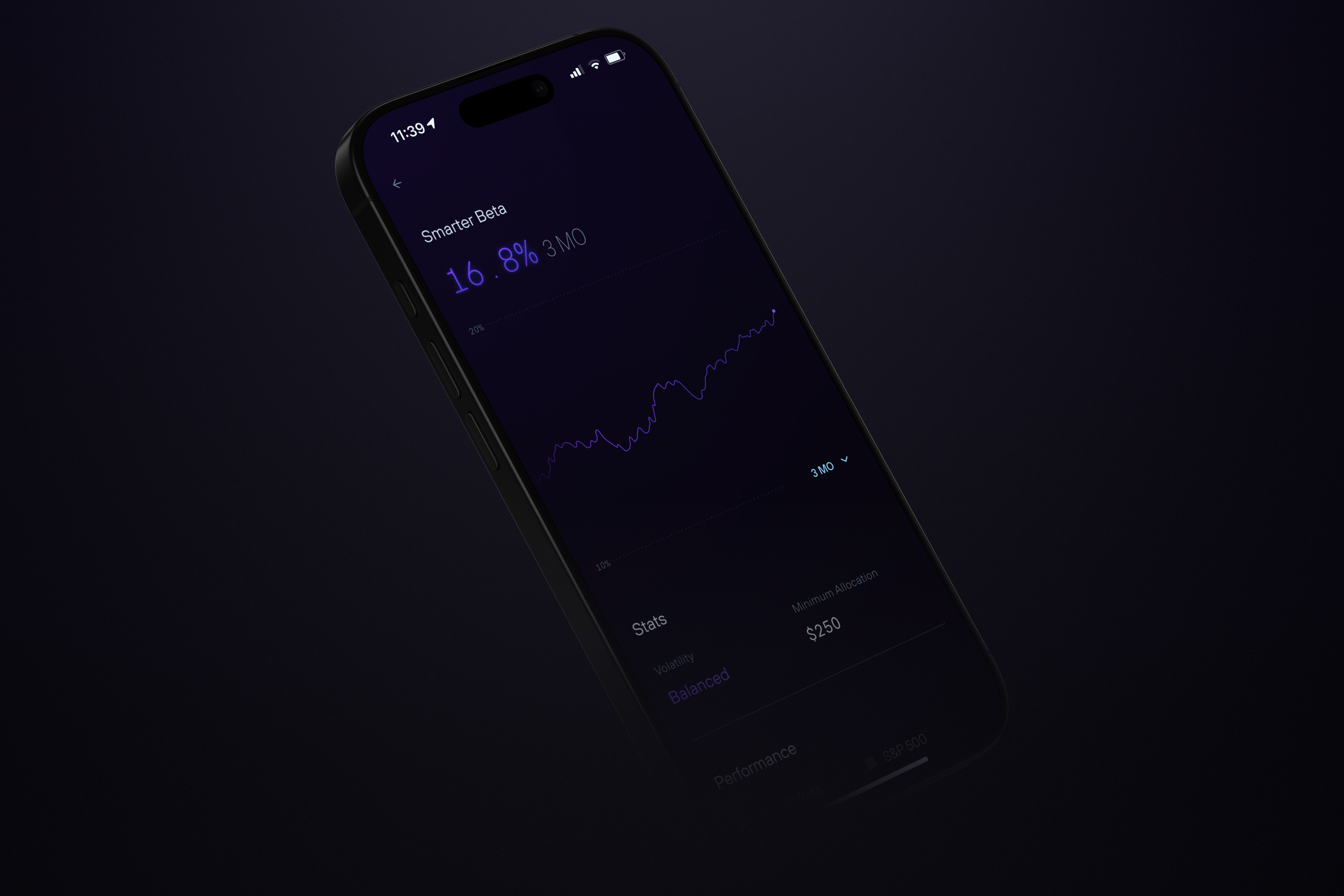

AI-powered projections made every investment decision personalThe kit details page reimagined investment evaluation. Instead of buy buttons and ticker symbols, users saw personal projections: "Investing $500 in Smarter Beta could grow to $1,178 in 5 years."

One-tap portfolio addition eliminated trading complexity. No order types, no share calculations. Just "Add to AI Portfolio" and the system handled everything—rebalancing, allocation, integration. Users weren't buying stocks; they were funding their future.

Performance data provided context without triggering FOMO. Volatility profile, holdings breakdown, benchmark comparisons—all designed to answer one question: "How does this help me reach my goal?" The AI had already determined this kit could help. Now users could see exactly how.

The AI even suggested optimal funding amounts based on goal progress: "$250 keeps you on track."The AI remembered user preferences and streamlined repeat funding. After initial setup, one-tap deposits became the norm—the system pre-selected your preferred amount and payment method. While APEX clearinghouse handled the institutional-grade verification in the background, our debit card integration provided an immediate funding pathway. This eliminated the single point of failure that plagued other platforms: Plaid's token expiration no longer meant starting over. Users could fund instantly via debit while their bank connection processed, or switch seamlessly between methods.

VIIMPACTBehavior transformed

Conversion jumped from 3.1% to 22.7%, stabilizing at 13.9%. But the numbers only hint at the transformation. Users were following their guided strategies. Liquidations plummeted as transparency preempted confusion. Average funding exceeded $500—users weren't just testing the platform, they were committing to their futures.

We'd proven something profound: design could reshape financial behavior. Not through education or persuasion, but through every pixel working in concert to create goal-driven investors.

3.1% → 13.9%

Conversion to funded accounts

$500+

Average funded amount in the first 60 days

15,000+

Funded accounts in ~8 months

VIICREDITSFOUNDER & CEOSR. PRODUCT MANAGERPRINCIPAL PRODUCT DESIGNERStephen Mathai-Davis

Zachary Tobin

Aaron Smith

Dedicated to an investing legacy

In Memory of Stephen Mathai-Davis (1982–2022)